Accounting plans within the non-profit sector, in particular, have experienced unique challenges during this time of unprecedented upheaval. The COVID-19 pandemic has created disruption in virtually every industry, and accounting is no exception. There’s never been a greater need for not-for-profits to pivot, think outside the box, and be creative: especially for associations that primarily provide in-person (people-facing) services.

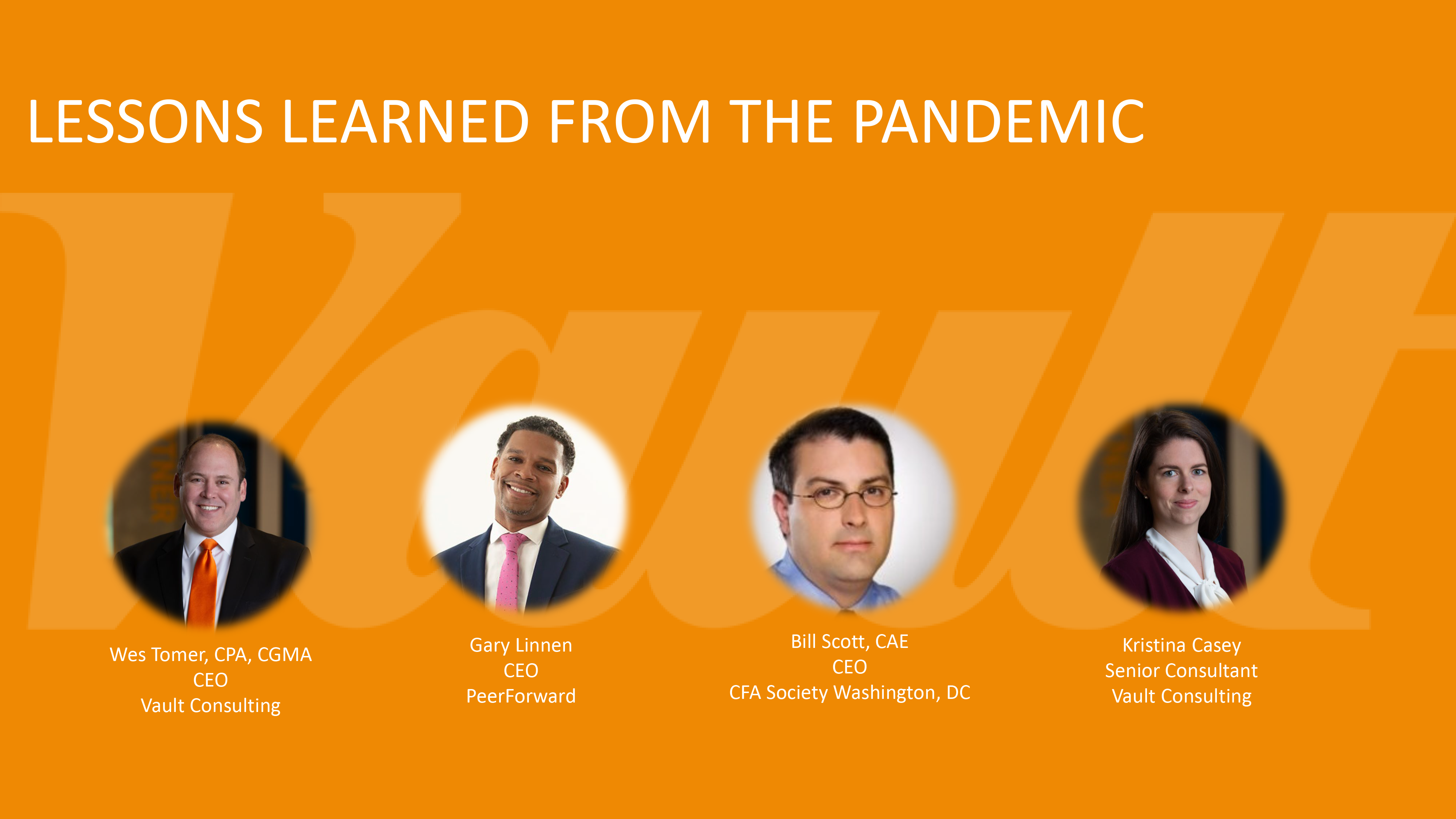

From staff turnover and system failures to crisis management, the team at Vault Consulting has advised several not-for-profit teams on best practices during the COVID-19 pandemic. We sat down with Vault Senior Consultants Kristina Casey and Sade Hinton-Morris as they uncovered the biggest lessons they’ve learned to help your association thrive through COVID-19.

Use Technology and Internal Controls to Overcome Disruption

Technology has arguably become the most important factor for overcoming COVID-19 related disruption. “There’s been a big push to get everything digital and cloud-based. Especially for our clients that had a lot of manual processes- specifically as it relates to things that are very timely,” said Casey. Making time-sensitive processes that involve cash (such as bill-pay and cash collections) automatic has been a great way to streamline otherwise time-consuming processes. “It’s [all] about getting clients to ‘think virtual’”, said Hinton-Morris.

It’s important to note, however, that the advent of more cloud-based computing technology has created an even greater need for robust internal controls.

“Segregation of duties in a remote environment is really magnified. It’s important that we think about how [technology tools] are going to be used and what the approval workflow is going to look like,” said Casey. Create strong internal controls for your not-for-profit that include the segregation of duties principle of least privilege in order to mitigate risk and keep workflow efficient for your organization.

It’s also worth noting that disruptions to personnel have been commonplace during COVID-19. Whether from childcare needs or remote-work and health issues, having standardized, automated accounting processes in place makes these COVID-related changes in retention easier to navigate. They also ensure less of a learning curve during training as new team members come on board.

Lessons Learned From COVID-19

“I think investing in cloud-based computing proactively is important. A lot of clients had to invest reactively,” said Casey.“It’s important to properly train employees and put disaster recovery plans in place before your not-for-profit needs them,” she added. Taking a proactive approach to implementing new technology systems (rather than a reactive one) allows you to better vet the software that will work best for your association. While third-party accounting services like Vault can add value if the need arises to set up new systems quickly, it’s always better to have time on your side when possible.

Another important lesson to be learned from COVID-19 is that diversification of your not-for-profit’s revenue is critical. “Cash is always important, but COVID has really highlighted that because those dependable revenue streams have been disrupted,” said Casey. Because more funders are focused on issues and programs that are COVID relief-related, there’s more competition (particularly for associations that don’t fall directly into those COVID-related categories).

Your not-for-profit may not be able to depend on previous sources of revenue (particularly dues-based revenue) to remain solvent. “A lot of clients had to tap into their lines of credit, or some had to tap into investment reserves to make sure operations stayed afloat,” said Hinton-Morris. This means establishing other sources of non-dues revenue (such as research programs) is more important than ever for your association.

COVID and Beyond: The Future of Strategic Planning

“It would be a disservice to get our clients thinking we’re going to just return to how things were prior to COVID,” explained Casey. If you want your association to become stronger from COVID, take the pandemic as a learning experience and use it to establish a new normal for your association.

“With the move to cloud computing, there are new risks to consider,” said Casey. As a result, an “effective new normal” should include creating a culture of risk assessment and risk management. Because security risks are inherent to the cloud computing programs being introduced, developing a comprehensive risk management program (giving focus to IT, security, and reputational risks) will be imperative to succeed both during and post-COVID.

Aside from realizing a new normal, check-in on employee engagement to see how your teams are handling changes. “We’re real people doing this job. Employee engagement and talent retention are essential. It’s vital to be able to check the pulse of your organization- including your accounting department,” said Casey.