Accurate, timely, transparent accounting for nonprofits is essential to secure stakeholder trust and the financial contributions that allow nonprofits to drive their mission forward. With strong financial processes and reporting in place, nonprofits are better equipped to reduce risk and plan for the future. Yet many nonprofits today are facing challenges in finding and maintaining the accounting staff needed to keep up with the pace of rapid regulatory change and evolving reporting demands.

These hardships are not unique to accounting for nonprofits. However, nonprofit organizations may find that these added challenges can prevent them from meeting stakeholder expectations and compliance requirements. By understanding these challenges, nonprofits can begin to identify solutions, including lessons learned by other organizations.

1. Worsening accountant shortages

Nonprofit leaders are often experts when it comes to stretching the extent of their impact with limited resources. However, when it comes to accounting, many nonprofits are increasingly facing a different type of shortage: labor.

As of 2024, data from Bloomberg puts the national accountant shortage at more than 340,000 positions. Retiring Baby Boomers account for some of those open positions. However, the Society of Human Resources Management reports that accountants in the 25- to 34-year-old range and mid-career professionals are also leaving the field. The number of new graduates with accounting degrees has decreased for nearly a decade. As Bloomberg puts it, this accelerating shortage is reaching crisis levels.

Experts attribute this shortage to several factors, including the field’s image. The perception of a profession in which graduates can expect to work long hours behind their desks isn’t attracting Gen Z graduates who prioritize flexibility at work. Moreover, many students seem to find the fifth year of higher education required to earn Certified Public Accountant licensure as an unworthwhile investment for a profession that has seen compensation levels stagnate. When it comes to accounting for nonprofits, where tight budgets can make it challenging to offer competitive pay, this may pose a particular challenge.

These staffing shortages have the potential to compound nonprofits’ existing accounting challenges by adding to the strain on the remaining staff. It’s also contributing to a knowledge gap that may be increasingly difficult for nonprofits to bridge.

To maintain timely, accurate reporting, nonprofits may have to think outside the box about how they manage their accounting function. Solutions may consider a remote workforce, outsourced accounting, and technology solutions that enable new levels of efficiency, as we’ll discuss over the next several chapters.

2. More frequent regulatory changes

As Bloomberg reports, financial errors are a challenge even large public firms face today as a result of the worsening accountant shortage. Nonprofits with limited resources may find the risk of errors becomes even higher when their accounting professionals are tasked with keeping up with increasing regulatory changes.

Over the last decade, the Financial Accounting Standards Board has issued a multitude of new accounting pronouncements. Nonprofits must be able to stay abreast of these changes so that they can interpret and apply relevant pronouncements to their organizations. If your staff isn’t up to speed on the latest updates, nonprofits run the risk of non-compliance with Generally Accepted Accounting Principles.

3. Greater demands for reporting transparency

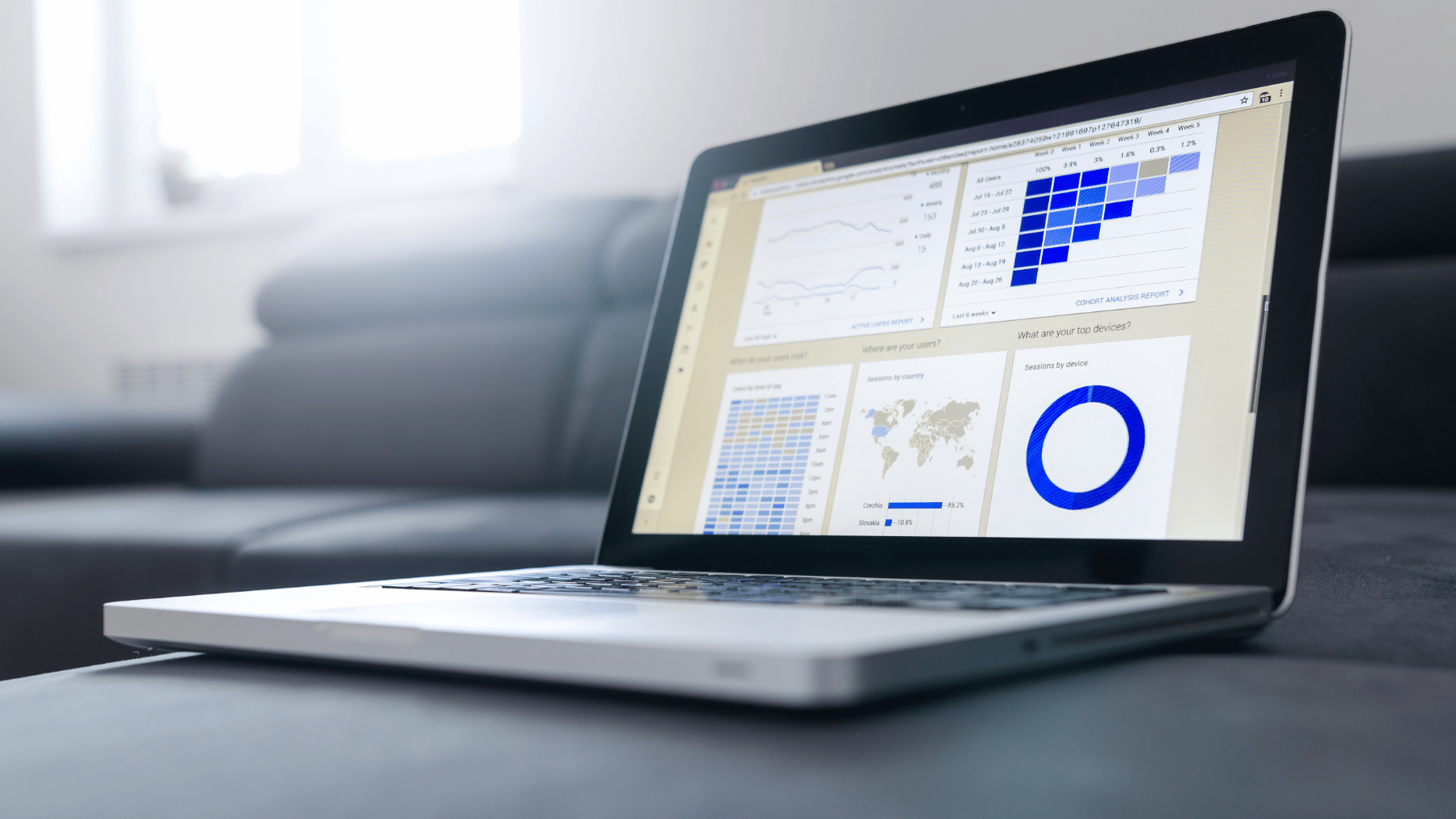

While all industries are struggling to keep pace with evolving GAAP requirements, nonprofits have added reporting expectations that are also evolving. Nonprofits have always had a responsibility to donors, members, and other stakeholders to ensure that their finances align with their mission. However, reporting transparency has gained more weight as a metric by which to measure nonprofit success.

The public is increasingly holding nonprofits accountable for improper use of funds. As a result, accounting for nonprofits may come under closer scrutiny. For example, the Federal Trade Commission now recommends checking an organization’s reviews on an online rating website before donating to any non-governmental organization. In addition, research indicates that donors are 53% more likely to contribute to a nonprofit that is transparent with its information.

Fortunately, financial transparency can be as simple as ensuring that your board, management, and other key decision-makers can glean essential information about your organization’s financial health through your reporting. Clear, accurate reporting, supported by strong internal controls, enables nonprofits to deliver the transparency their stakeholders expect and deserve.

New solutions address these accounting challenges

While these challenges may seem daunting, nonprofit organizations do have solutions at hand. Some organizations are finding that they can fill their knowledge gaps with support from third-party accountants. Others are turning to new technology solutions to boost their efficiency in meeting these growing demands.

To deliver timely, accurate reporting that serves their stakeholders and their mission, nonprofits must think outside the box about how they manage their finances. Working with a third-party consultant may help nonprofits gain the timely expertise they need without investing in additional positions. To learn more about how a consultant can help you navigate these challenges while modernizing your accounting and reporting, connect with the experts at Vault.